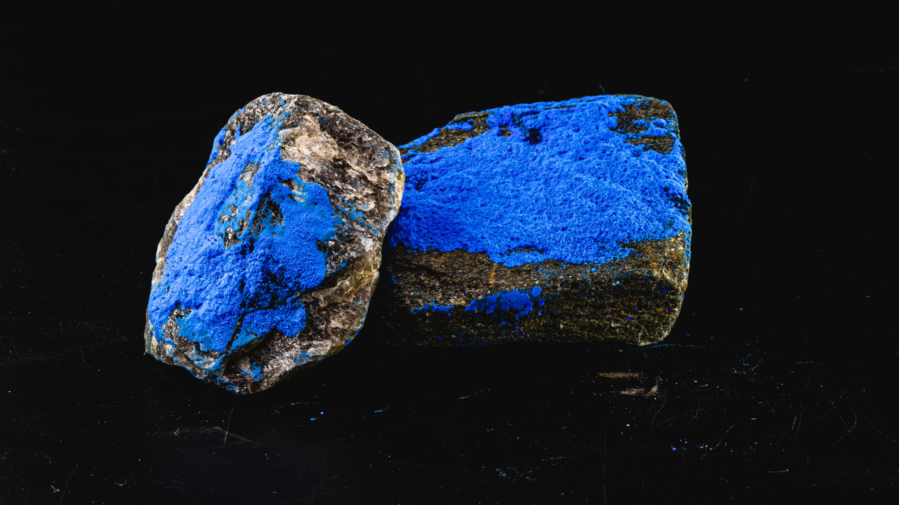

You may be familiar with the intense hues of cobalt blue, a rich coloring agent made from the salts of cobalt used since antiquity by many cultures in art and ceramics. Cobalt blue glass beads were even found in a 3,400-year-old Danish burial site.

But what of cobalt’s importance and value today? And if it is valuable, how can we invest in it?

The Importance of Cobalt in the Modern Economy

Cobalt is a metal and one of the basic chemical elements found on Earth. In its pure form, it looks like nickel and iron. Cobalt is number 27 on the periodic table of the elements.

Cobalt is hugely important for a diverse set of industrial, commercial, and military applications. Of particular importance is its essential use in the production of rechargeable battery electrodes – which is critical in the manufacturing of electric vehicles. It is increasingly being used in nanotechnology and super-alloy applications as well.

Cobalt is also used in magnets and magnetic recording applications, to make paints, varnishes, and pigments. It is used in the manufacturing of airbags, diamond tools, and steel-belted radial tires for the automobile industry. The metal is used as a catalyst in the petroleum and chemical industries and is needed for modern porcelain production.

In addition to its modern commercial uses, it’s also needed in small quantities for human health and well-being. It is an essential component of vitamin B-12 and is important in the body’s ability to regulate the nervous system and produce red blood cells. It is also used in some forms of cancer treatment, particularly when that disease affects the brain.

Where is Cobalt Found and Produced?

Cobalt is not found as a stand-alone mineral but instead occurs naturally in a chemically combined form. Most cobalt is mined as a byproduct of copper and nickel mining. Pure cobalt, a hard, lustrous, silvery blue-gray metal, is produced by reductive smelting.

Cobalt is not distributed evenly across our planet. Today, the vast bulk of cobalt, 69 percent, is mined in the Democratic Republic of Congo (DRC), specifically in the Central African Copper Belt, which has reserves of over 3.5 million tons. In second and third place are Australia and Russia, each of which mine 4 percent of the world’s total. Perhaps even more concerning, 65 percent of the global supply of cobalt is consumed and processed by China, where more than 80% of its refined cobalt is used by the rechargeable battery industry. Finland and Belgium are far behind China in second and third place in global cobalt processing.

The United States continues to become more dependent on imports to meet the domestic demands for an increasing number of mineral commodities including cobalt. Domestic cobalt reserves are estimated at only 55,000 tons, most of which are found in Minnesota.

How to invest in Cobalt

As you have seen, cobalt is a critical ingredient for many high-tech and green-revolution applications. Its demand is expected to increase yearly. By 2030, the demand across the globe is expected to rise to between 230,000 and 430,000 tonnes, which is over 1.5 of the world’s current production capacity. Because of its essential need in the modern global economy and coupled with its relatively short supply, especially in the United States, you may be interested in investing in cobalt.

Finding stocks in companies that mine or produce cobalt can be difficult. One way is to invest in large publicly-traded metal mining companies, such as BHP Billiton (BHP) or Rio Tinto (RIO). These companies produce large amounts of other critical mineral resources and pay generous dividends as well.

You may wish to look into junior cobalt exploration companies. Jervois Mining (JRVMF) may be attractive as it aims to become the leading global supplier of responsibly sourced cobalt and nickel. Several Canadian junior cobalt explorers, all of which trade on the Toronto Venture Exchange, include Fuse Cobalt Inc. (FUSE-TSXV), Surge Battery Metals Inc. (NILI-TSXV), Fortune Minerals Ltd. (FT-TSX), and Battery Mineral Resource Corp. (BMR-TSXV). Other possibilities for your research exist in companies such as Cobalt Blue Holdings and Australian Mines, both listed on the Australian Stock Exchange (ASX).

If you are comfortable with futures investing, there is a place for those interested in profiting with cobalt. Cobalt futures can be found on the London Metal Exchange under the symbol CO.

Another possibility to benefit from the need for cobalt is to look for opportunities in the recycling space. Currently, about 15 percent of U.S. domestic cobalt consumption comes not from mining but from recycled scrap. This is a small but growing arena and shrewd investors should research the possibilities in this developing space.

Social and Environmental Concerns Regarding Cobalt Investing

It would be remiss not to mention the environmental and social impact of cobalt mining. In the DRC, cobalt mining, which is controlled by Chinese interests, is notorious for child labor abuses. Even in places where humans are protected during mining operations, the environmental impact of this activity can be quite severe.