If you’re wondering about why there’s such a wide variety of tax forms available from the IRS, you’re not alone. There are hundreds of them — literally — and it’s not always clear what they’re for and why you might need to file them. While there are probably some, like the 1040 forms, that you’re familiar with because you encounter them on a regular basis, there are plenty of others you might’ve just heard about for the first time. Form 941 is one form you might not have seen before — unless you work in a payroll department.

This form serves as a reconciliation between businesses and the IRS and includes all employees’ names and payroll information. But it goes a little deeper than that. Here’s what you need to know about Form 941 and how to file it.

What Is Form 941?

Form 941 serves a purpose both for individuals and for businesses. It keeps a total of all the paycheck deductions from your gross pay that go toward Medicare and Social Security. Employer contributions on your behalf also show up on Form 941. Although employees don’t receive this form, the information on the form goes on the tax forms you get at the end of the year.

Employers generate this form for each employee at the end of each financial quarter, and the form generated at the end of the fourth quarter shows the sum of all contributions an employee made throughout the year. Form 941 also tallies the business’ total number of employees, total wages paid out throughout the year and the sum of employer contributions made for all employees over the year.

What Is the Purpose of Form 941?

Form 941 serves as an accounting between employers and the IRS. Many businesses use payroll software that automatically forwards all deductions from employee paychecks to the IRS. However, some businesses still manually mail checks to the IRS, and calculations from software aren’t infallible.

The 941 form displays the total amount of deductions the business should’ve forwarded to the IRS throughout the year, and the IRS can compare that number with the actual amount it received from the business. Deductions from employee paychecks belong to the IRS. They’re not income and aren’t the business’ property.

In addition to providing accountability for deductions, 941 forms also tell how much the business should’ve paid throughout the year in payroll taxes. If the business paid less than it should have, it needs to include a payment for the difference along with the filing of 941s.

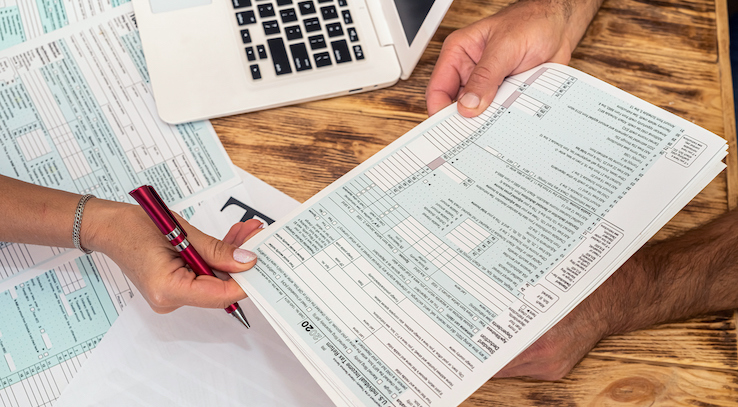

What’s on Form 941?

On the top of Form 941, you list the business name, the EIN and the business address. There are separate spaces for name and trade name. For a corporation, both of these may be the same. Sometimes, a business may have a DBA that can go in the trade name section.

For example, XYZ Restaurant Group may be a holding company that owns several restaurants. Still, its XYZ Cafe and XYZ Diner may be separate businesses with separate trade names filling out separate 941 forms. This also applies in the case of a business owned by a sole proprietor that has a trade name. For example, sole proprietor Danny XYZ may be completing the form for his business with the trade name XYZ Skate Shop.

There’s a different Form 941 for each year, so be sure to use the appropriate year’s paperwork for filing. There’s also space to check off which financial quarter the information is for. The first page has space for the total number of employees who received pay during the quarter, the total sum of compensation paid to employees during the quarter, and the total amount of withholdings and payroll tax payments the business was responsible for during that period.

A simple sum of all employee compensation and taxes paid doesn’t tell the whole story for every business. Some compensation isn’t simple wages, including salaries, tips, bonuses and commissions. There are adjustments for certain types of compensation, such as sick pay, and certain types of leave. Businesses also pay compensation in the form of employer contributions to COBRA coverage, and some businesses contribute to employees’ retirement accounts. You’ll see spaces on the 941 to note these additional payroll expenses that some employers incur. Some of these expenses are refundable as credits from the IRS, and others aren’t.

In addition to all the grand totals, Form 941 has space to list compensation and deductions for each employee. For some businesses, it makes more accounting sense to prepay estimated payroll taxes to the IRS. If a business takes this route, there’s space on the form to reconcile the difference between the prepaid estimate and the actual taxes incurred throughout the quarter.

When and How to File Form 941

Although the information on Form 941 plays a role in your income taxes and the benefits you’ll be eligible for if you retire or become disabled, it’s your employer’s responsibility to file Form 941 on behalf of everyone who works at the company. Businesses are responsible for sending this form to the IRS every quarter. There are four quarterly deadlines for filing 941 forms, and they fall on or around April 30, July 31, October 31 and January 31. If a business has no employees, it’s not required to file Form 941. If a business pays less than $1,000 annually in payroll taxes, it may be able to complete Form 944 instead.

To submit Form 941, it’s often easiest to e-file the form using one of the approved vendors the IRS has selected. If you process payroll through a payroll or accounting software provider, it’s quite likely that the software generates 941 forms on your behalf. The software may even e-file the forms and forward necessary payments without any extra action on your part.

You can also mail in 941 forms to the IRS. The IRS publishes a list of mailing addresses. Be sure to read them carefully; there are different addresses for different regions, and you’ll need to send forms that include payments to different addresses.

If you’re an employee, you don’t have to worry about creating or filing Form 941. Your employer makes the quarterly filing, and your employer is the one who’ll face a penalty for failing to file. All of the information on a 941 form that pertains to you is included on your W-2 at the end of the year, and you can use that information to file your taxes.